Budget Worksheet

Consequently, you’ve decided to settle down and finally learn how to make a budget worksheet. Perhaps this is the second, third, fourth, or fifth time, but now, you mean it when you say “for everyone.” Consequently, you’ve decided to settle down and eventually learn how to make a budget spreadsheet. Perhaps this is the second, third, fourth, or fifth time, but this time you mean it when you say “for everyone.”

Since you didn’t have the proper method, just one explanation you’re not completely structured, reasonably active, financially secure, or able to find matching socks in the morning is that you didn’t! You would already be crushing it if you had purchased a fresh notepad, matching sticky notes, highlighters, colored pens, pattern printed tape, and beautiful staplers specifically for that assignment.

To succeed in the big scheme of things in sock pairing and financial planning, I’m aiming to make the idea that while the technique is vital, developing the behavior in your everyday life is essential. Therefore, rather than discussing another discarded book, let’s discuss creating a personal budget that will become a part of your everyday existence.

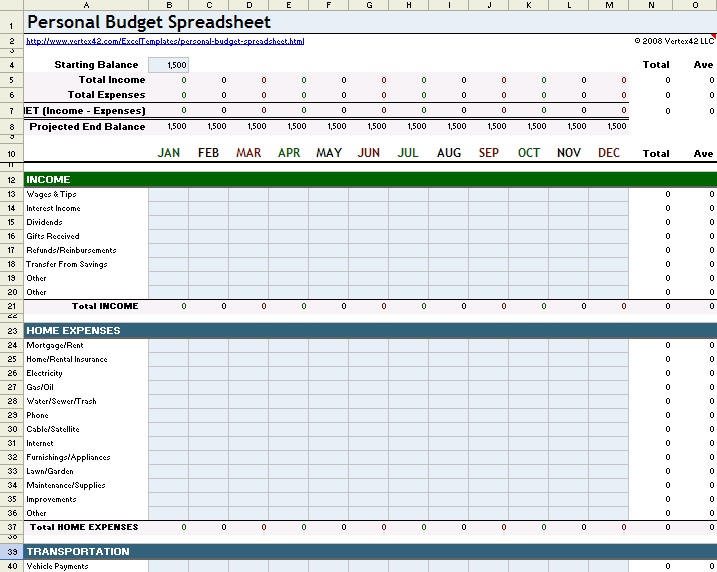

Requisites for producing a budget worksheet

- monthly income (use your take-home pay)

- regular costs

- Non-regular costs

- Aims to save

- Spending objectives ‘Just for pleasure’ expenditures

Establishing a Budget Worksheet

Generate two new sections and name one “Designated” and the other “Accessible” after listing your various categories and the categories that belong to each. With a budget spreadsheet or perhaps YNAB, the remaining steps will be simpler to set up and manage.

First Step: How Much Do You Need?

To begin with, you must consider the cost of each of those expenditures. While establishing everything set up for the first time, don’t get bogged down in this; assuming is perfectly OK.

Your money awareness will cause your spending plan strategy to change as you progress.

Lease, mobile phone, energy, student loan payments, health insurance, and other monthly bills are rather simple to calculate. Split your average by the length of time it requires for that expense to reanimate for non-monthly or variable expenses. Like Christmas gifts, auto registration, car insurance, or annual subscriptions so that you can make maintainable monthly contributions rather than swallowing the entire amount when it arises.

Second Step: How Much Do You Have?

Check your account status next. It would be best if you currently allocated that sum of funds to each of these groups. The ideal allocation of your funds is based on due dates and priority.

Consider your current financial situation and what has to be done with it before your next paycheck. Continue allocating funds from your bank account to your categories until none are left. The objective is to accomplish that.

Avoid making arrangements with money you don’t currently have, such as upcoming salaries. Although it may seem difficult, trust me—crucial. It’s focused on what has to be done with your money for more money to come in; you don’t need to have enough funds for every area right now.

Third Step: Gain

Follow the instructions until you are more conscious of your spending and how it impacts your living. After that, you’ll start making more deliberate decisions and finally, be able to cover this season’s expenses with funds left over from the prior month.